2025 Backdoor Roth Contribution Limit

2025 Backdoor Roth Contribution Limit. They can’t contribute at all if they earn more than $161,00 a. If you’re under 50, you can contribute up to $23,000 and if you’re 50 or older you can contribute up to $30,500.

In 2025, the contribution limits rise to $7,000, or $8,000 for. So, let’s say you made a contribution for 2025, and the maximum for 2025 is $7,000.

Simple Irs Contribution Limits 2025 Dore Nancey, The phaseout occurs between $146,000 and $161,000 for single filers and $230,000 and $240,000 for joint filers in 2025. The limit for contributions to traditional and roth iras for 2025 is $7,000, plus an additional $1,000 if the taxpayer is age 50 or older.

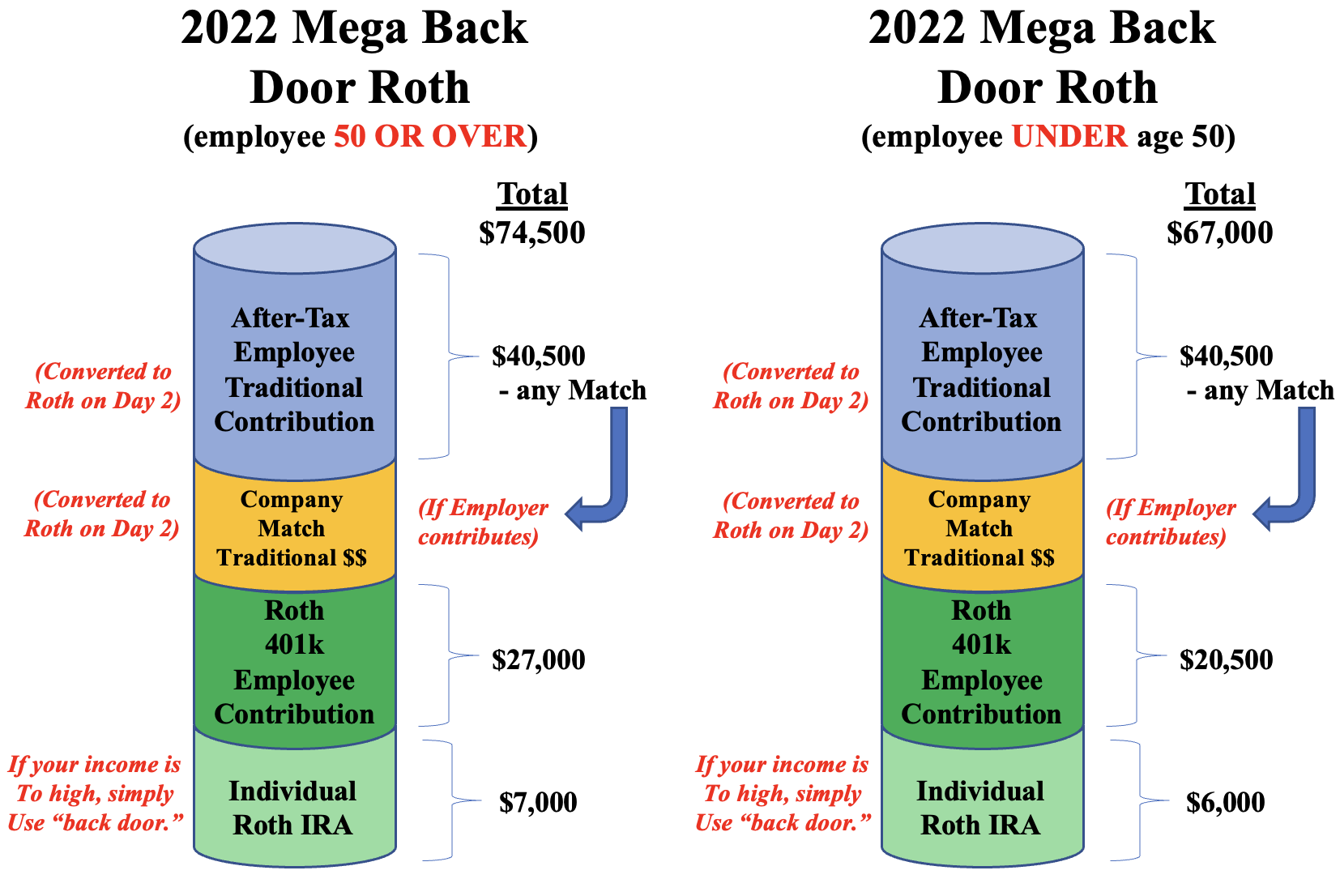

2025 Roth Contribution Max Agata Ariella, The mega backdoor roth allows you to save a maximum of $69,000 in your 401(k) in 2025. The ira contribution limits for a particular year govern the amount that can be contributed to a traditional ira to start the backdoor roth process.

The Magic of the Mega Backdoor Roth Mark J. Kohler, How much can you convert to a backdoor roth? How much can you put in a mega backdoor roth in 2025?.

2025 Simple Ira Contribution Ilise Leandra, The ira contribution limits for 2025 are. A backdoor roth ira is a roth ira that is created when those who cannot open roth iras due to income limits convert their traditional iras into a roth ira.

Roth IRA Contribution Limits and Using the Backdoor Conversion, Single taxpayers with modified adjusted gross incomes (magis) of at least $146,000 in 2025 have lower roth ira contribution limits. So, let’s say you made a contribution for 2025, and the maximum for 2025 is $7,000.

How To Use a Backdoor Roth for TaxFree Savings, In 2025, the contribution limits rise to $7,000, or $8,000 for. Are mega backdoor roths still allowed in 2025?

Amazon Mega Backdoor Roth Sophos Wealth Management, Less than $146,000 if you are a single filer. How does this add up?

2025 Contribution Limits Announced by the IRS, For 2025, you can contribute $7,000. Taxpayers making more than the $161,000 limit in 2025 can’t contribute to a roth ira, but they can convert other forms of ira accounts into roth ira.

Roth IRA Limits And Maximum Contribution For 2025, So, let’s say you made a contribution for 2025, and the maximum for 2025 is $7,000. If your employer matched any of your yearly contributions, your mega.

The IRS announced its Roth IRA limits for 2025 Personal, How much can you put in a mega backdoor roth in 2025?. This is a 2025 backdoor roth tutorial, so i put the $7,000 into the 2025 column.

Taxpayers making more than the $161,000 limit in 2025 can’t contribute to a roth ira, but they can convert other forms of ira accounts into roth ira.